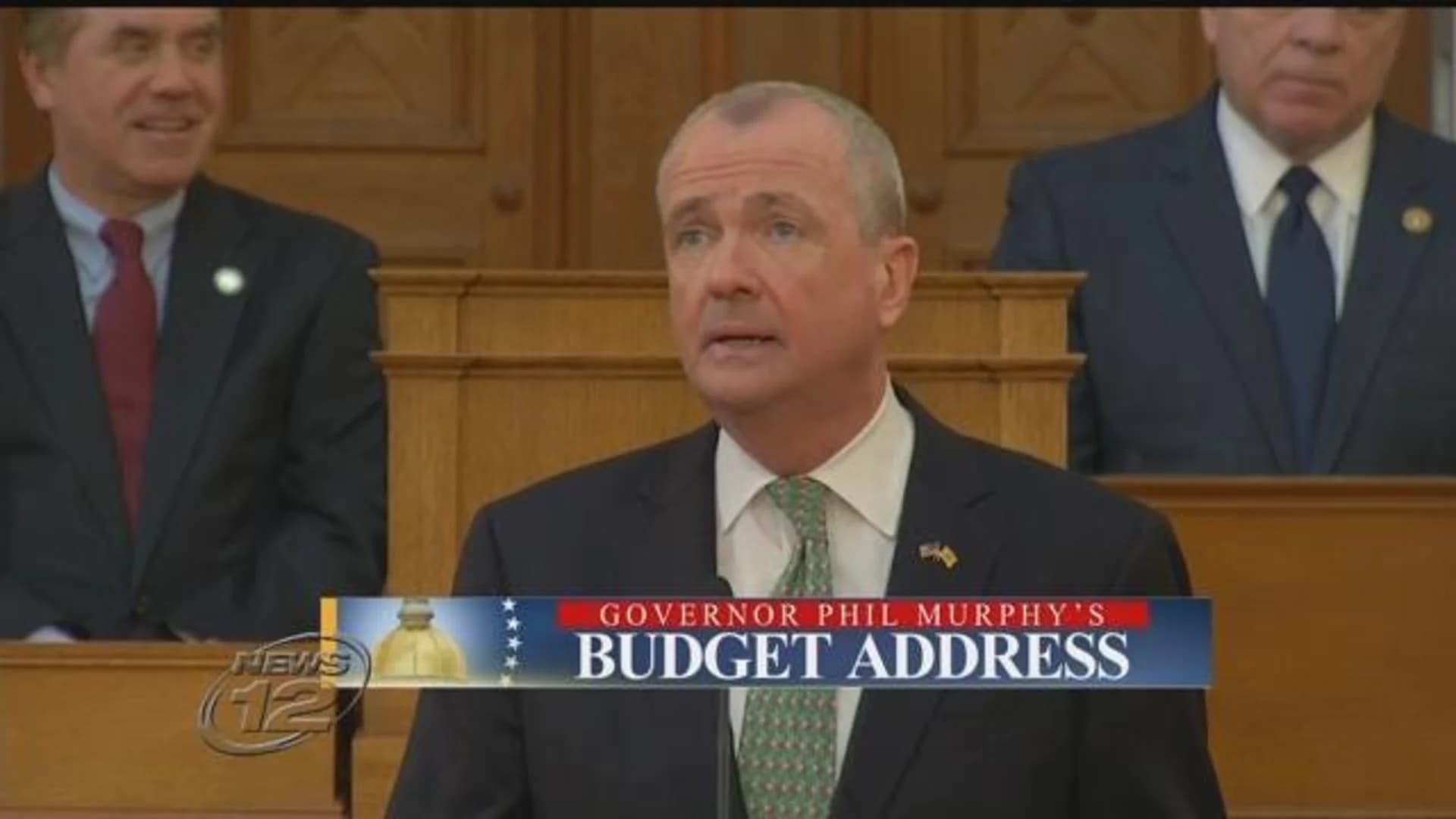

Gov. Phil Murphy unveiled details of his $38.6 billion state budget for the 2020 fiscal year – an increase of about $1 billion from the current budget.

The governor said in his address Tuesday that he would finance the new budget with higher income tax rates on wealthy residents and savings in public worker benefits.

Among the changes Murphy proposes are boosting income tax rates to the top bracket of 10.75 percent from 8.97 percent on people making more than $1 million. He's also calling for a boost to New Jersey Transit, K-12 school aid and a higher public pension payment. The budget also has a 16 percent decrease in public worker health benefits.

FULL ADDRESS: Gov. Phil Murphy Fiscal Year 2020 Budget Address

Republican lawmakers say that an increased tax on the wealthy would simply cause those residents to leave New Jersey, taking the tax revenue with them.

HIGHLIGHTS

TAXES

Murphy proposed higher income tax rates for people earning over $1 million.

Murphy proposed higher income tax rates for people earning over $1 million.

His proposals seek to apply the state's top bracket of 10.75 percent, which is currently levied only on incomes over $5 million, to people making more than $1 million.

The Democratic leaders who control the Legislature have said they oppose higher taxes. It's unclear how Murphy's spending proposal could be balanced without the roughly $450 million in revenue from the tax on the wealthy.

SAVINGS

Murphy says his proposal reflects a projected a 16 percent decrease in the cost of public worker health benefits. The savings are expected to come from shifting workers into cheaper health care plans, lowering costs related to out-of-network providers as well as from booting ineligible dependents from state plans, such as divorced spouses.

Murphy says his proposal reflects a projected a 16 percent decrease in the cost of public worker health benefits. The savings are expected to come from shifting workers into cheaper health care plans, lowering costs related to out-of-network providers as well as from booting ineligible dependents from state plans, such as divorced spouses.

Murphy says about $200 million will come from state government staff reductions and other "departmental savings."

SCHOOL AID

The budget calls for a $206 million boost in state aid for pre-kindergarten to 12th grade. That's a 3 percent increase over the current year's budget. Increased education aid, the governor said, helps reduce the need of school districts to raise their property tax rates.

The budget calls for a $206 million boost in state aid for pre-kindergarten to 12th grade. That's a 3 percent increase over the current year's budget. Increased education aid, the governor said, helps reduce the need of school districts to raise their property tax rates.

HIGHER EDUCATION

The governor is calling for increasing this year's $25 million allocation for tuition-free community college by $33.5 million. He says the beefed-up fund should help over 18,000 students get a two-year degree.

The governor is calling for increasing this year's $25 million allocation for tuition-free community college by $33.5 million. He says the beefed-up fund should help over 18,000 students get a two-year degree.

NEW JERSEY TRANSIT

Murphy is calling for an additional $100 million in general fund subsidies for the state's transit agency. That will bring the subsidy from about $307 million to $407 million.

Murphy is calling for an additional $100 million in general fund subsidies for the state's transit agency. That will bring the subsidy from about $307 million to $407 million.

PROPERTY TAXES

Murphy is asking lawmakers to approve $201 million for a property tax relief program that benefits seniors and disabled residents by freezing their rates. He's also budgeted $283 million in property tax rebates for moderate-income families. Those rebates translated to $202 a year in rebates for eligible homeowners in 2018.

Murphy is asking lawmakers to approve $201 million for a property tax relief program that benefits seniors and disabled residents by freezing their rates. He's also budgeted $283 million in property tax rebates for moderate-income families. Those rebates translated to $202 a year in rebates for eligible homeowners in 2018.

The Associated Press wire services contributed to this report.

More from News 12

2:24

STORM WATCH: Potential blizzard could bring 2 feet of snow to parts of New Jersey

3:43

NJ Transit braces for impacts as potential blizzard nears

2:52

Gov. Sherrill declares state of emergency ahead of massive snowstorm

1:48

New Jersey shoppers stock up as another major snowstorm approaches

2:18

Hundreds plunge at Manasquan Beach to raise funds for people with ALS