More from News 12

Officials: 1 person killed, 1 injured in house explosion in South River

1:20

Pro-Palestinian protest that postponed final exams at Rutgers ends peacefully

2:19

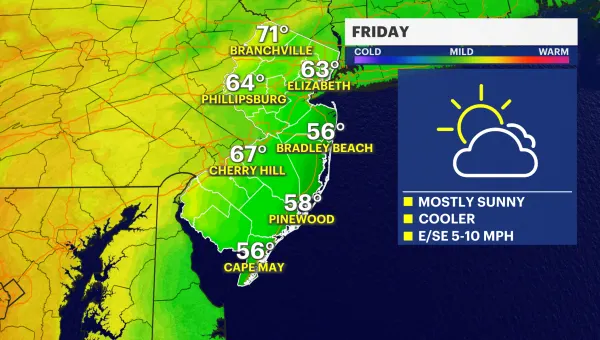

Mostly sunny Friday ahead with cooler temperatures; tracking weekend rain

2:17

Bound Brook starts Lithium Ion Identification Program to help firefighters identify risks

0:57

Funeral services held in Newark for Rep. Donald Payne, Jr.

0:22

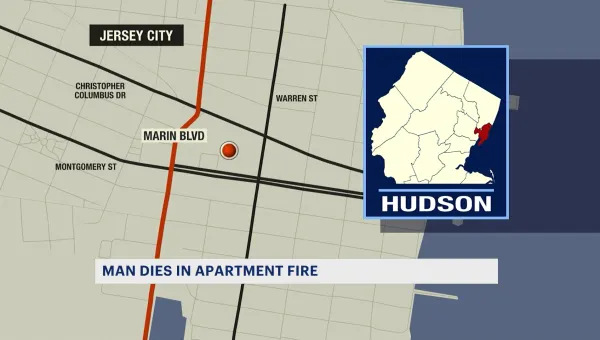

Prosecutor: 61-year-old man dies in Jersey City high-rise fire

0:36

Jersey Proud: Police officers gather for town cleanup in memory of fallen officer

1:26

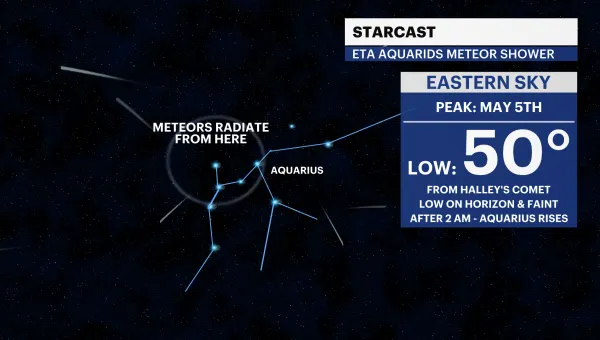

Look up! Annual Eta Aquarid meteor shower peaks early Sunday morning

NJ Transit teams with BetMGM to provide rail serves to MetLife Stadium concerns

0:46

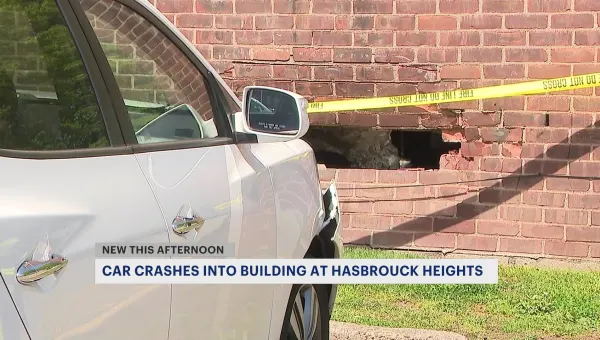

Car crashes into Hasbrouck Heights apartment building; residents evacuate

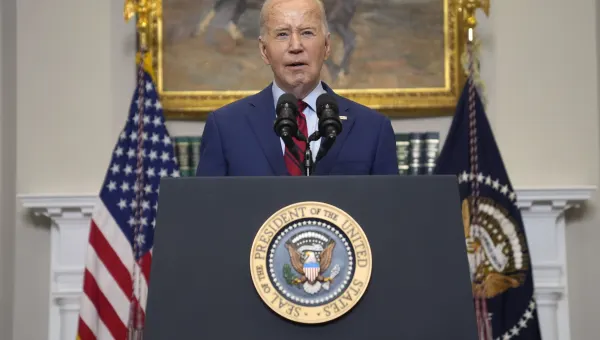

Biden says 'order must prevail' during campus protests over Gaza

2:13

Police: Explosion, fire at Old Bridge business kills 73-year-old woman, severely injures 4 others

0:47

Learn to make candles at Urban Glo in Union

3:52

I-95 in Norwalk closed until at least Monday following tractor-trailer fire

0:35

Prosecutors: NJ couple pleads guilty to starting illegal marijuana service and employing their son

0:24

Should former inmates be allowed to serve on juries in New Jersey? Gov. Murphy says yes

0:29

Unruly passenger ordered to pay over $20,000 for interfering with flight from London to Newark

0:20

Authorities: 2 women, 1 man stabbed in altercation at Newark McDonald's

0:19

FBI offering $5,000 reward for info on Paterson bank robbery suspect

0:24