More from News 12

2:08

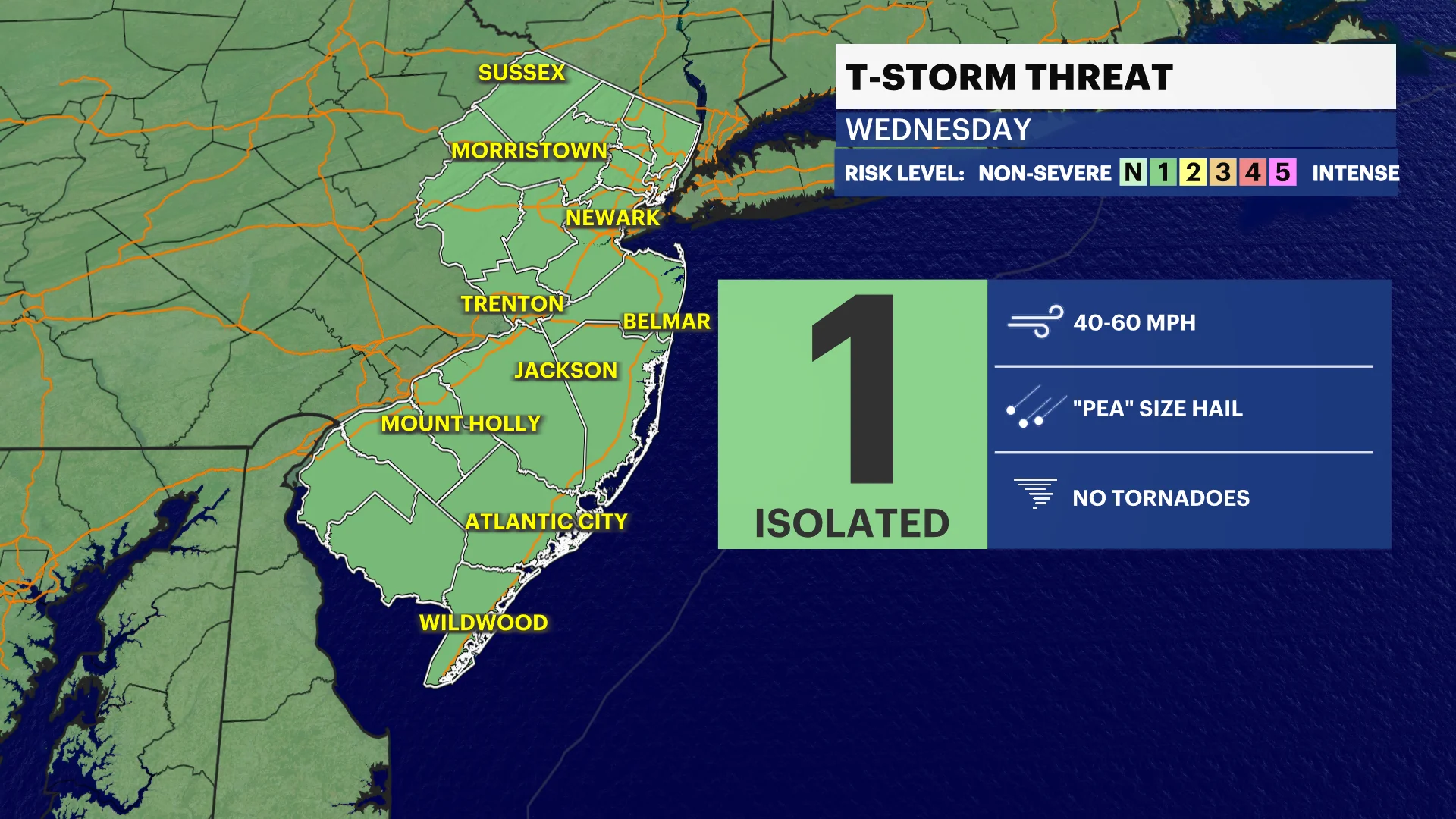

STORM WATCH: Isolated storms expected in New Jersey late Tuesday into Wednesday morning

2:03

Deadline to get a Real ID is in one year. Here's what you need to know

0:28

TSA officers arrest Florida man for having loaded gun packed in carry-on bag at Newark airport

0:35

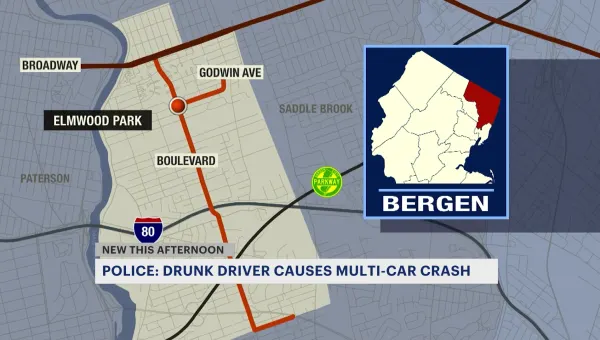

Police: Elmwood Park man drove drunk, struck 8 vehicles; 3 injured

0:25

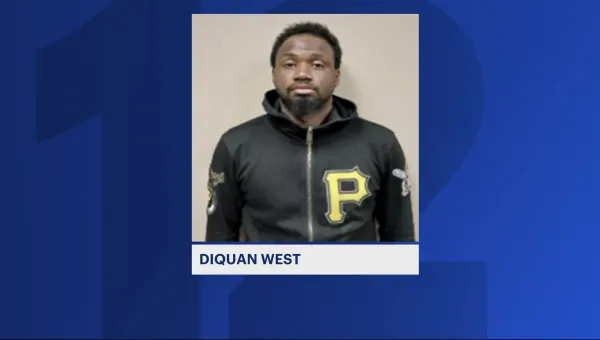

Paterson man faces slew of charges in connection to armed kidnappings

2:03

Best of New Jersey: A taste of everything the Dunellen Hotel has to offer

0:29

Walmart reaches settlement in class action lawsuit

0:33

Atlantic City man sentenced for drug induced deaths of tourists

0:26

Man killed in two-car Egg Harbor Township crash

0:48

Congressional action may help New Jersey seniors targeted by scams

0:37

Police: Man arrested after locking woman in crawl space in Atlantic City

2:09

Middletown moves forward with cheaper parking to offset NJ Transit fare increase

0:48

Authorities: Construction worker who suffered fatal fall worked for K&D Contractors

0:21

Rutgers president to testify before Congress on antisemitism on college campuses

2:06

First weekend of Newark’s youth curfew debuts to great success

1:41

Death of New Jersey state trooper during training incident prompts investigation

0:50

Jersey Proud: Somerset charter school competes in World Robotics Championship in Texas

0:16

Police: Hoboken man facing weapons charges in road rage incident

2:42