KIYC: Should New Jersey residents consider purchasing earthquake insurance?

Earthquake insurance is a lot like flood insurance. If you don't live in a flood zone, you're not required to have it, but you can purchase it if you want to.

Share:

More Stories

2:37

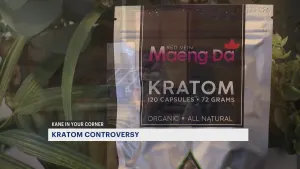

Kane In Your Corner: What you need to know about the use of herbal product Kratom

yesterday2:34

KIYC: NJ mayors call for tougher penalties for young criminals, but are juvenile crime stats increasing?

4ds ago1:47

Food labels can sometimes be misleading. Kane In Your Corner explains what to look out for.

15ds ago1:47

KIYC: Do earthquakes pose a risk to the tri-state area infrastructure?

24ds ago3:07

KIYC: Forensic nurse says there are systems in place to make rape exams less traumatic

40ds ago2:13

KIYC: Lawmakers put controversial public records bill on hold to add amendments

46ds ago2:37

Kane In Your Corner: What you need to know about the use of herbal product Kratom

yesterday2:34

KIYC: NJ mayors call for tougher penalties for young criminals, but are juvenile crime stats increasing?

4ds ago1:47

Food labels can sometimes be misleading. Kane In Your Corner explains what to look out for.

15ds ago1:47

KIYC: Do earthquakes pose a risk to the tri-state area infrastructure?

24ds ago3:07

KIYC: Forensic nurse says there are systems in place to make rape exams less traumatic

40ds ago2:13

KIYC: Lawmakers put controversial public records bill on hold to add amendments

46ds agoInsurance companies across New Jersey say they are seeing an increase in questions about earthquake insurance after a 4.8 magnitude quake struck Hunterdon County on Friday.

Earthquake insurance is a lot like flood insurance. If you don't live in a flood zone, you're not required to have it, but you can purchase it if you want to. But is it worth it?

A homeowners insurance policy typically will not cover earthquakes or earth movement. The insurance would need to be purchased separately. Earthquake risk is low in New Jersey. Friday's was the biggest in 140 years.

Because the risk is low, earthquake insurance is also very inexpensive in the Garden State.

If your property is prone to erosion, earth movement insurance may be worthwhile. Earth movement insurance doesn't just protect you in the event of an earthquake, it can be any kind of earth movement.

After Superstorm Sandy, News 12’s Walt Kane spoke to some homeowners whose foundations were damaged due to erosion and their homeowner's insurance didn't cover it.

In the end, this is an individual decision and one that you should talk over with your family and insurance agent.